Содержание

EToro allows traders to sift through Popular Investors by using a range of tools like Gain Percentage, Assets Traded, Profitable Weeks, Geographic Location, and others. When trading currency pairs, a forex signal system creates a buy or sell decision based on technical analysis, charting tools, or news events. Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. In general, however, copy trading is considered to be a form of investment activity and is subject to the same laws and regulations as other forms of investing. However, these risks can be mitigated by doing your research and carefully selecting who you copy trade with.

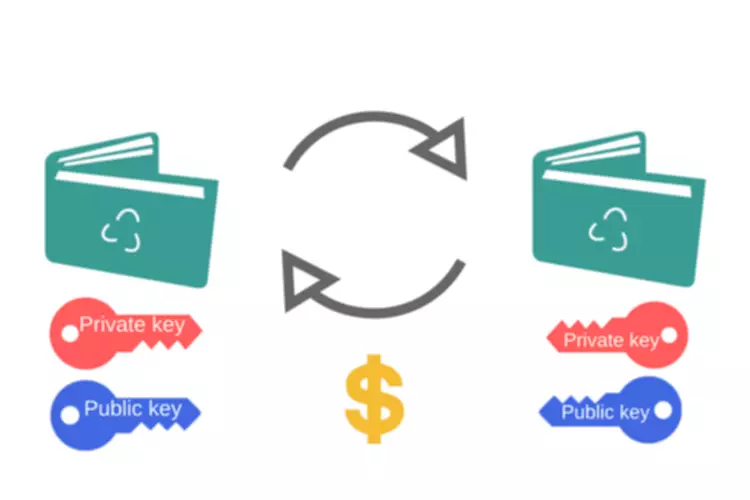

This allows inexperienced investors to benefit from the expertise of more experienced traders. One of the main reasons that clients use social trading platforms is to diversify their risk. By allocating different strategy providers with certain social trading platforms, clients are able to spread out their risk rather than relying on a single provider.

Tradency Mirror Trade

Copy trading can be a profitable way to invest, but it is important to understand the risks involved. Before you start copying the trades of others, make sure you are aware of the potential dangers and have a solid plan in place. Also, be sure to use a reputable broker that offers good customer support.

Top 5 Copy Trading Solutions 2022 – Market Research – Finextra

Top 5 Copy Trading Solutions 2022 – Market Research.

Posted: Fri, 25 Mar 2022 07:00:00 GMT [source]

Once you decide on a few Popular Investors that you want to copy, it is extremely simple to invest your money alongside them. Just allocate the amount of your holdings you want to copy trade with via the social trading platform, and your money will trade with the Popular Investors of your choice. Additionally, by diversifying their risk, clients are more likely to see consistent returns over time rather than experiencing large swings in their investment portfolio. Overall, social trading provides a way for clients to manage their risk and potentially maximize their returns.

With a bit of research and planning, copy trading can be a great way to make money. For example, if a trader has a minimal risk tolerance, they may choose to mirror a strategy that has a low maximum drawdown. Prominent forex brokers that offer mirror trading include AvaTrade, FXCM, and Dukascopy. The copy trading platforms make it possible for investors to own trading strategies used by successful traders.

Social Trading Vs Copy Trading

Mirror trading is a methodology of trade selection used primarily in forex markets. It is a strategy that allows investors to copy the trades of experienced and successful forex investors and implement the same trades, in almost real time, in their own accounts. Mirror trading was initially only available to institutional clients but has since been made available to retail investors through various means. Since its inception in the mid- to late-2000s, mirror trading has inspired other similar strategies, such as copy trading and social trading.

You can begin trading with automated signals or following another trader with as little as $200 from some providers. While copy trading can often lead to profit, there is also the potential for loss, especially if the markets become suddenly illiquid. If the trader you’re copying is forced to exit their positions at a loss, you’ll be facing those same losses. Copy-trading allows copying positions of another trader, and lately, it has become more popular. There are many traders who create ‘People-Based’ portfolios to invest in other investors instead of trading themselves.

- Copy trading is a type of investment where you copy the trades of another investor.

- With copy trading, investors can automatically mimic the trades of more experienced and successful traders.

- However, it’s important to remember that there are risks involved, and not all traders will be successful.

- Here, you just need to fund your account, leave it alone, and hope to see it grow, or you can monitor.

- Prominent forex brokers that offer mirror trading include AvaTrade, FXCM, and Dukascopy.

- Copy trading could be a good way to add risk to your portfolio, especially as a way to hedge larger, passive equity positions that would likely get caught up in a market sell-off.

Remember, the key to making money with copy trading is to choose a good trader to copy. If you can do that, then you will be on your way to making some serious profits. When it comes to investing, there are a lot of different strategies that can be employed in order to achieve success. Some people prefer to take a hands-on approach, carefully picking and choosing each individual stock that they invest in. Others may opt for a more passive strategy, investing in index funds or letting a financial advisor handle things.

Which Copy Trading Platform Is Best?

The amount you start with will largely depend on your goals and how much money you’re comfortable risking. Remember, copy trading is a speculative activity and you could lose all of your investment. However, copy trading carries a high risk of losing money, as you are effectively trusting someone else to make decisions for you. You should only invest in copy trading if you can afford to take this risk. If you are not comfortable with the idea of losing your money, then copy trading is not for you.

EToro offers its clients a wide range of trading tools, including copy trading. If you are looking for a safer way to enter the world of leveraged trading, copy trading could be a good fit. An exchange-traded fund is a basket of securities that tracks an underlying index. When you become a copy trader, you can earn a commission on the trades that you make. This means that you can specifically target profitable traders and earn a percentage of their profits. This is a great way to make money because you can learn from the best and make profits without having to put in all the hard work yourself.

Copy trading is a type of investment where traders copy the portfolio of another trader. There are different trading strategies that depend on the goals and preferences of the investor. However, all trading strategies involve copying the trades of another trader in order to earn profits which has its risks involved as well.

ZuluTrade supports over 40 forex brokers, one of which being their integrated solution . It allows investors with existing brokerage accounts to link a new account via their existing broker easily. It helps you to discover other investor’s stats on the leader board and select who to copy to get the highest profit in your trade. A daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

See Our Full Range Of Trading Resources

Copy trading can be done manually, by following the trades of another investor manually, or through automated copy-trading platforms. Automated copy-trading platforms will execute trades on your behalf based on the parameters that you set. Yes, copy trading is legal in most countries, provided that the broker itself is properly regulated. When investing in the financial markets using a regulated-broker and legalizes your account and the traders carried within them. However, all of these completely depend on your country that you are living in.

As the popularity of social trading continues to grow, it is likely that more and more clients will use these platforms to save on fees. Before eToro and ZuluTrade, there was Tradency – a pioneer forex broker that offers both social and copy trading services within its native mirror trader platform. It helped the social trading niche as most of the new social trading sites borrow heavily from its operations. However, as most networks sought to come up with more social trading tools, Tradency chose to maintain its original mirror trading tool.

Best Crypto

In the stock market, they may use broker services such as Interactive Broker’s Interactive Advisors or a third party site such as collective2.com for example. Some investors might choose to copy only the trades of a single trader, while others might build a portfolio by copying multiple traders. Some platforms also allow investors to automatically what is copytrading copy the portfolios of traders who meet certain criteria, such as consistent profitability. Social trading is an aspect of trading in the forex markets that encompasses direct and indirect forms of collaborative trading. In it’s less than a decade of active operations in the industry, Myfxbook has morphed into a household name.

This is one of the best copy trading platform, which helps you filter brokers based on minimum Deposit to start forex trading, mobile support, etc. ZuluTrade also allows login via Facebook, convenient for those who regularly log in to check their account. The number of trading strategies you can copy at any given time is dependent on the forex broker’s rules of engagement. When you are social trading, you are either trading in collaboration with the trading gurus or using their informed marketing strategies to your advantage. Trading in collaboration involves getting trading insights from these pro traders for free or at a fee.

Social Trading Explained

For this reason, it’s important to be aware of market conditions and have an investment strategy that can weather storms. This copy trading platform also offers the FXTM Invest service for a minimum deposit of $100. Provides access to a wide range of markets and offers 100 trading instruments all in one platform. The brand that traditionally dealt with stock, commodities, and futures CFDs also has in its product list crypto coins. It is available on both the MT4 desktop and mobile app, and you will need a minimum initial deposit of $500 to start trading. To help you identify the best traders to copy, social trading websites have come up with professional trader qualifications.

Retail investor accounts should be aware that copy trading may not always be profitable, and there is the potential for losses as well as gains. Overall, though, copy trading platforms can be a useful way for retail investor accounts to make money. With copy trading, investors can choose which traders they want to follow and automatically copy their trades. Copy trading, also known as social trading, is a relatively new phenomenon that has taken the investing world by storm. With copy trading, investors can automatically mimic the trades of more experienced and successful traders.

This website is free for you to use but we may receive commission from the companies we feature on this site. Social trading refers to the different finance and investment industry player’s ability to interact freely, share ideas, and network. We are especially drawn to it because of their recently launched Binary Cent trading feature – an advanced social trading feature that supports https://xcritical.com/ crypto copy trading. Social trading is a form of networking that brings traders, investors, and analysts into one interactive environment. Here, they get to share ideas and insights about the industry while others get to collaborate in forex trading projects. A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair.

Copy trading is an interesting innovation and eToro has created a solid platform that just about anyone can use. Read our complete review of eToro here if you’d like to know more about this broker. When it comes to copy trading, there is no simple answer to the question of whether or not it is legal. The legality of copy trading depends on a variety of factors, including the specific regulations in place in your country and the broker you are using. Both of these methods have their own advantages and disadvantages, so it’s important to understand the differences between them before deciding which one is best for you.

This, according to Tradeo, makes it possible to social trade in a more personalized manner. They also have highly effective copy trading features that let you copy your favorite pro trader’s strategies and automatically replicate them on your trading account. For traders that want to ability to actively speculate on the macro markets, and also have managed trades by established investors, eToro could be a good choice. It is very simple to trade in and out of numerous markets, and also drop capital into copy trade accounts that are in essence passive investments. The Top Trader Copyportfolio puts your money to work with the best performing traders on eToro’s social trading platform.

Glossary Of Trading Platforms

It’s important to remember that copy trading is a risky investment strategy, and you should always do your own research before investing. Nonetheless, for those who are willing to take on the risk, copy trading can be a convenient way to access the world of online trading. For beginners, copy trading can be a great way to learn about the markets and generate profits without incurring too much risk. Additionally, copy trading can help to diversify one’s portfolio and to take advantage of opportunities that might otherwise be missed. If you’re looking for a way to make some extra money, then consider taking advantage of cash bonuses from copy trading platforms.

Ultimately, the best copy trading platform for you will be the one that meets your specific needs and provides a positive user experience. You need to consider many factors while selecting your copy trading software. The biggest drawback of this trading method is that you have to mirror everything. Leverage will amplify your gains, but it will also create much larger losses if the market moves against your position. You will also be able to see their current open trades and portfolio distribution, which can help you decide if you like the markets they trade. Your money will be traded by the Popular Investors you choose, on a totally passive basis.

This means that even inexperienced investors can tap into the wisdom of the crowds and potentially make money. In these trading methods, companies combine their top traders’ strategies to produce reliable and accurate signals for their consumers. Today, it is considered an ideal method as it is much improved with big data and artificial intelligence. As a result, mirror trading is relatively accurate and predictable; they are perfect for investors who want to know all the forex trading.